zodiacbet Whales’ Rolling Window: Assassins, Rate Cuts and Portfolio Allocation

Disclosure: This is a sponsored post. Readers should conduct further research prior to taking any actions. Learn more ›zodiacbet

The result of the US election is an essential factor affecting the process of interest rate cuts and liquidity return. After Trump was assassinated but survived, the result of the US election seems to have been locked in advance, which means that more interest rate cuts seem to be on the way. In this case, most risky assets will benefit, and crypto assets and commodities, as non-equity assets with potentially better performance, may get more shares in portfolios.

More Rate Cuts?

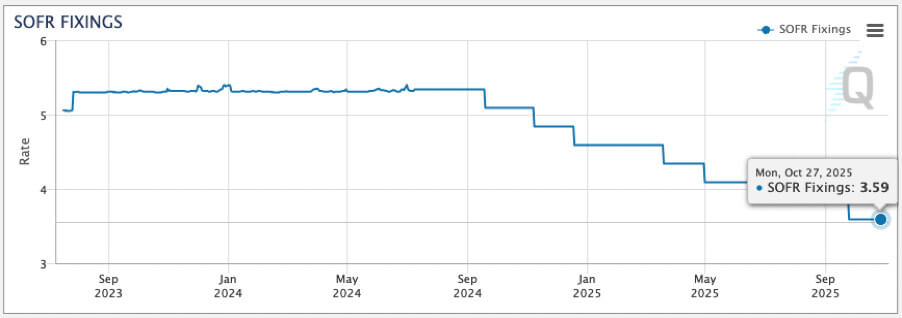

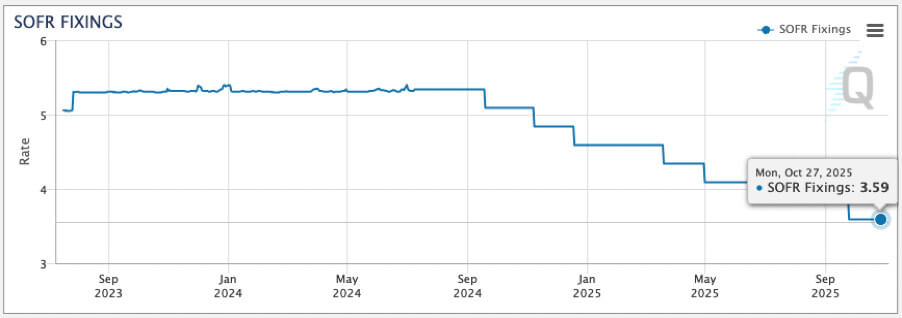

Compared to June, investors’ expectations for interest rate cuts have become much more optimistic in July. Even in the “robust” interbank market, traders have expected the federal funds rate to fall below 3.6% in Oct 2025, and the number of rate cuts this year may even exceed two.

Implied expected changes in interest rate levels from SOFR futures, as of Jul 16, 2024. Source: CME Group

The latest CPI data is one reason that affects traders’ expectations. The US unadjusted CPI YoY recorded 3.0% in Jun, lower than the market expectation of 3.1%, marking the lowest level since June last year. The seasonally adjusted CPI MoM for Jun was -0.1%, the first negative value since May 2020.

The Fed has repeatedly emphasized over the past year that the threshold for rate cuts is not merely “inflation returning to 2%” but “the Fed being more confident in inflation returning to 2%.” Following this inflation report, it can be said that the Fed has almost met the threshold for rate cuts, suggesting that a global rate-cutting cycle is about to begin.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/investing-chart.jpg" alt width="1280" height="749" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/investing-chart.jpg 1280w, https://cryptoslate.com/wp-content/uploads/2024/07/investing-chart-300x176.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/investing-chart-1024x599.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/investing-chart-768x449.jpg 768w" data-sizes="(max-width: 1280px) 100vw, 1280px" />Changes of US MoM CPI data, as of Jul 16, 2024. Source: Investing.com

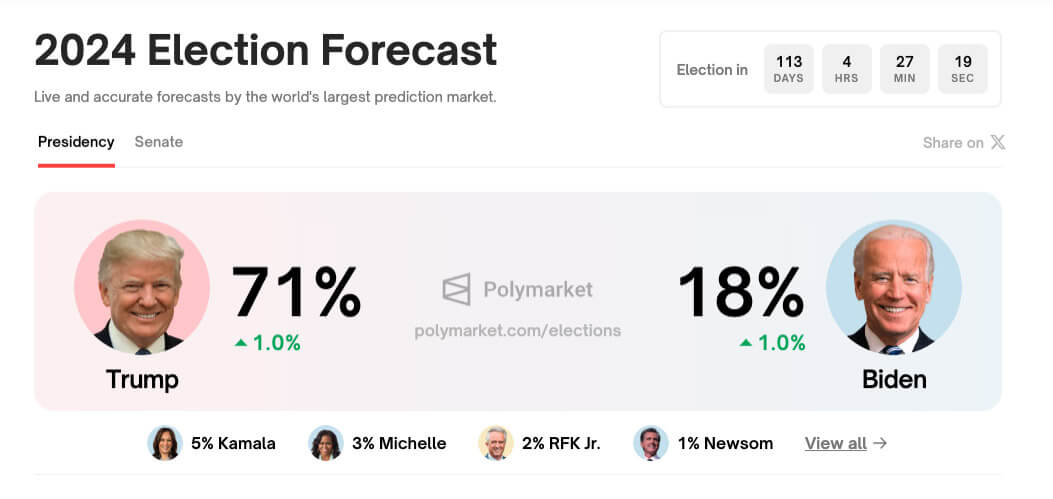

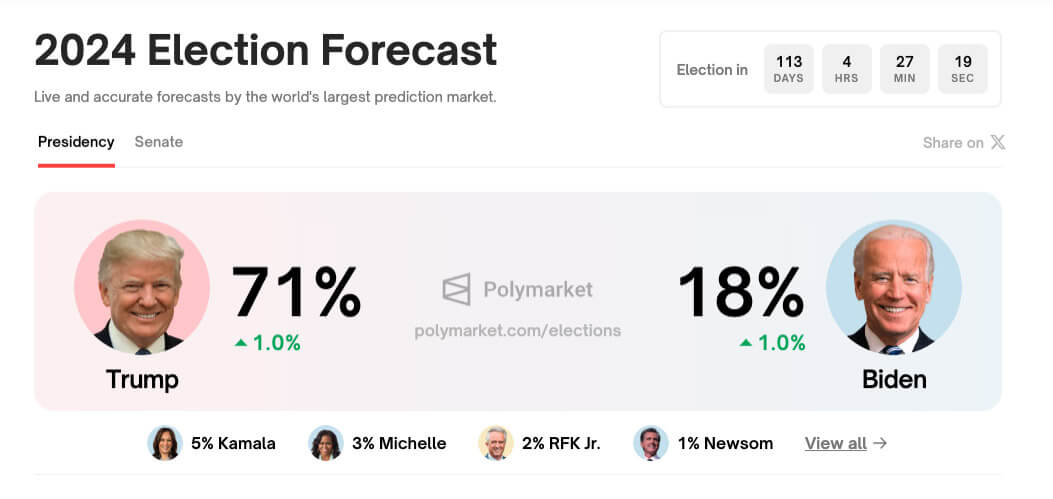

Although many investors are concerned about the risk of re-inflation, as is the Fed, another factor – the US election – is changing the weight of re-inflation risk in the eyes of the Federal Reserve. After surviving last Sunday’s assassination, it is almost certain that Trump will win the 2024 election. According to data from the prediction market website Polymarket, Trump’s winning rate has risen to 71%, which means that the possible impact of his future economic policies should be taken into account early.

Considering that Trump is “very dissatisfied” with Powell’s current high-rate policies and passive attitude toward lowering interest rates and stimulating the economy, the Fed may compromise on interest rate policy after Trump’s election, which means that more aggressive interest rate policies may emerge and bring a significant release of liquidity in the next 1-2 years. However, there is no doubt that this will come at the cost of possible future inflation and recession.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/2024-election-forecast.jpg" alt width="1053" height="499" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/2024-election-forecast.jpg 1053w, https://cryptoslate.com/wp-content/uploads/2024/07/2024-election-forecast-300x142.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/2024-election-forecast-1024x485.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/2024-election-forecast-768x364.jpg 768w" data-sizes="(max-width: 1053px) 100vw, 1053px" />2024 US election win rate for different presidential candidates, as of Jul 16, 2024. Source: Polymarket

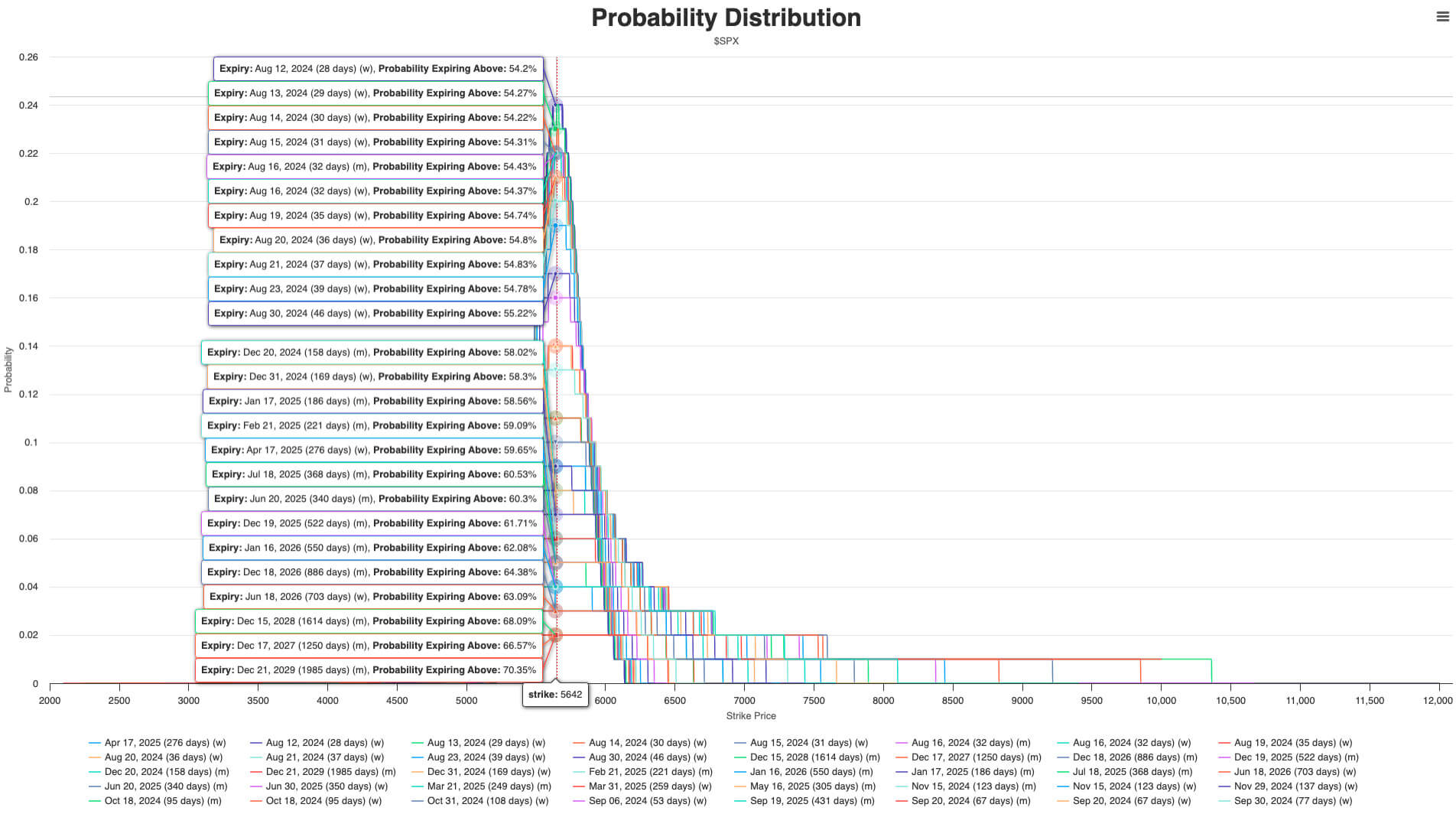

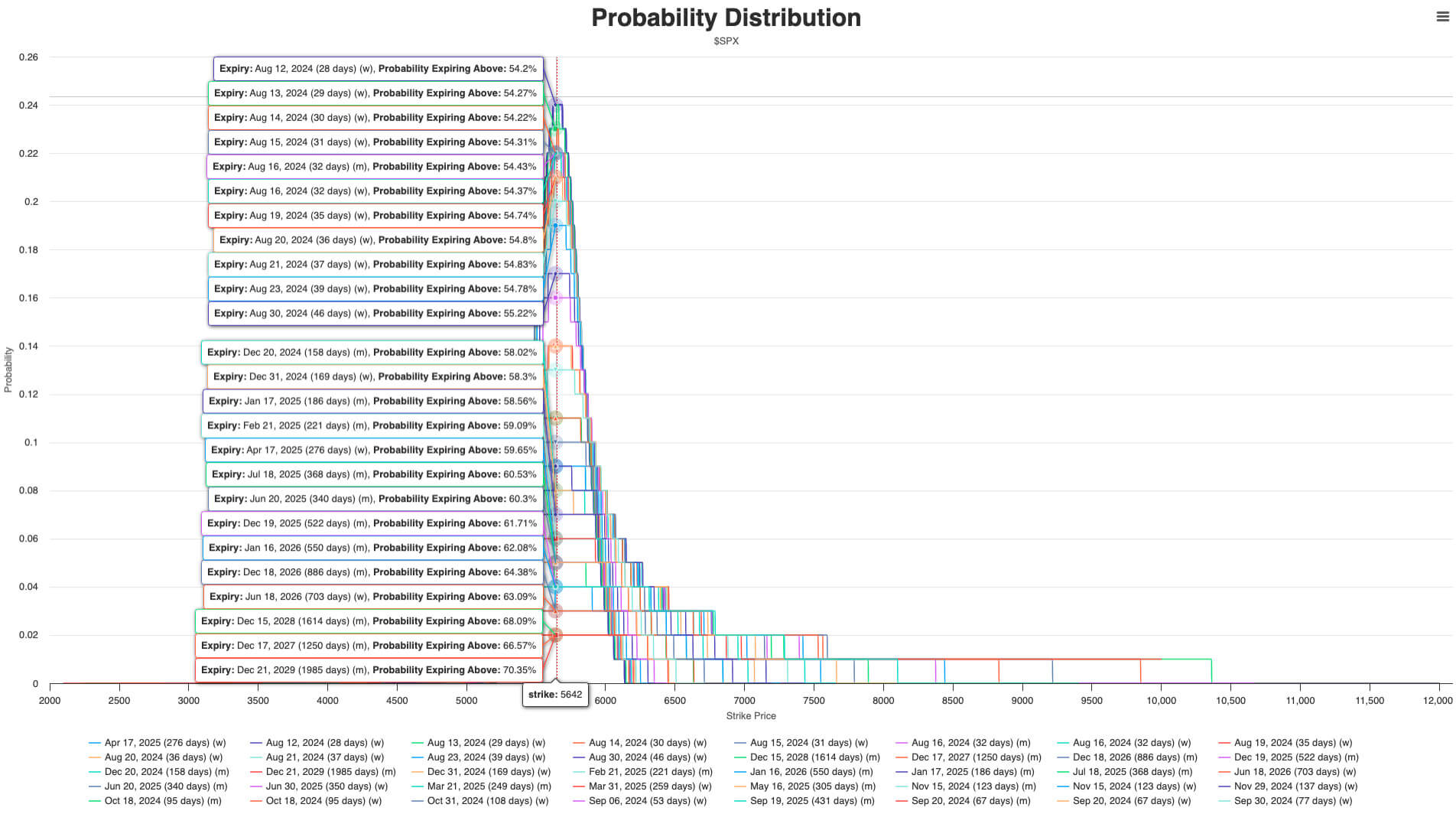

It must be admitted that most investors do not care about what happens in 3-5 years. The expectation of interest rate cuts is evident in stimulating the risk asset market: the probability distribution implied by SPX options is generally biased towards bullish, and this bullish sentiment has even pervaded investors’ expectations for the next 1-2 years. The above situation means that investors expect traditional large companies to benefit from Trump’s economic policies and achieve better returns in the future.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/probability-distribution.jpg" alt width="1904" height="1064" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/probability-distribution.jpg 1904w, https://cryptoslate.com/wp-content/uploads/2024/07/probability-distribution-300x168.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/probability-distribution-1024x572.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/probability-distribution-768x429.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/probability-distribution-1536x858.jpg 1536w" data-sizes="(max-width: 1904px) 100vw, 1904px" />Implied probability distribution of SPX (S&P 500 Index) far-month options, as of Jul 16, 2024. Source: optioncharts.io

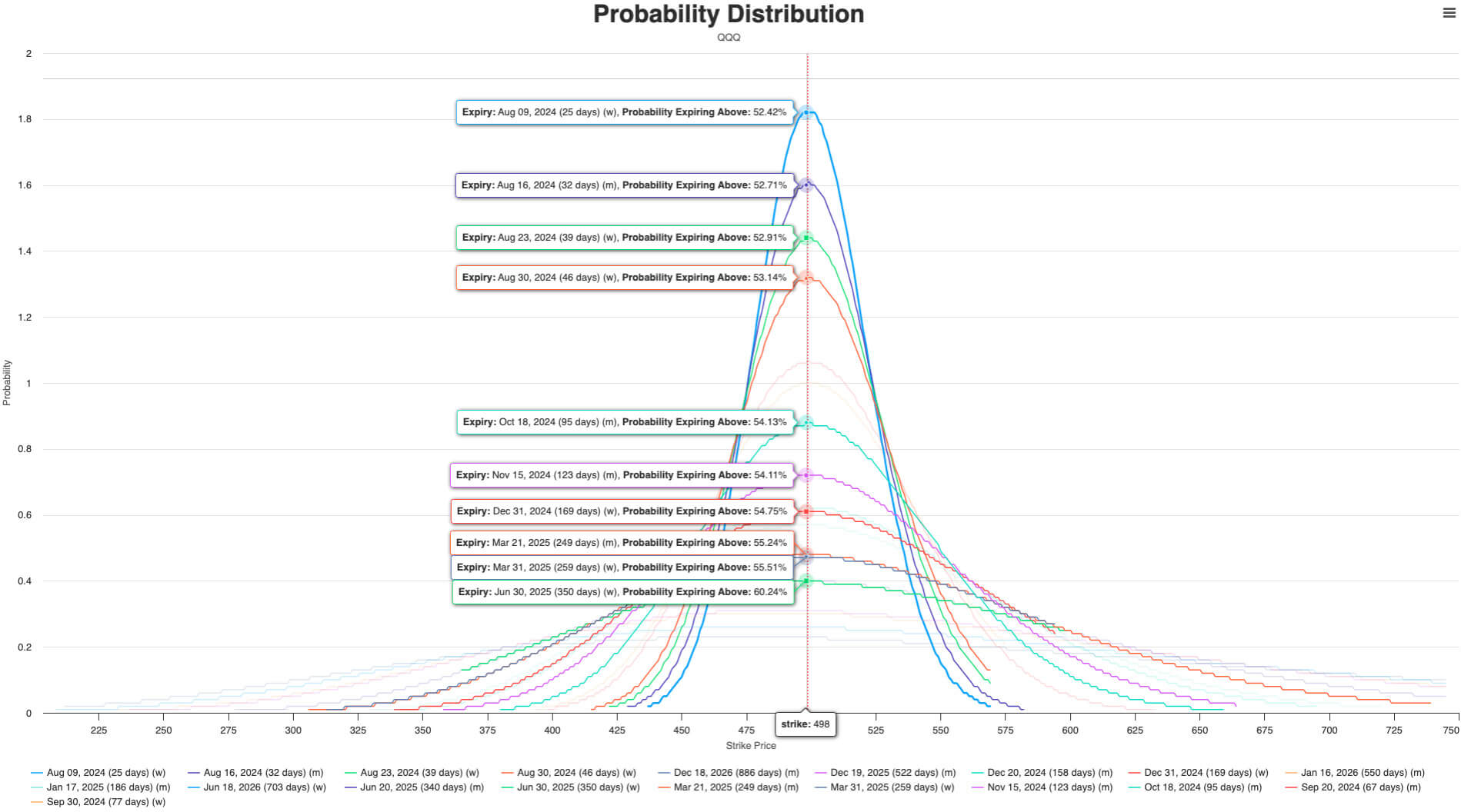

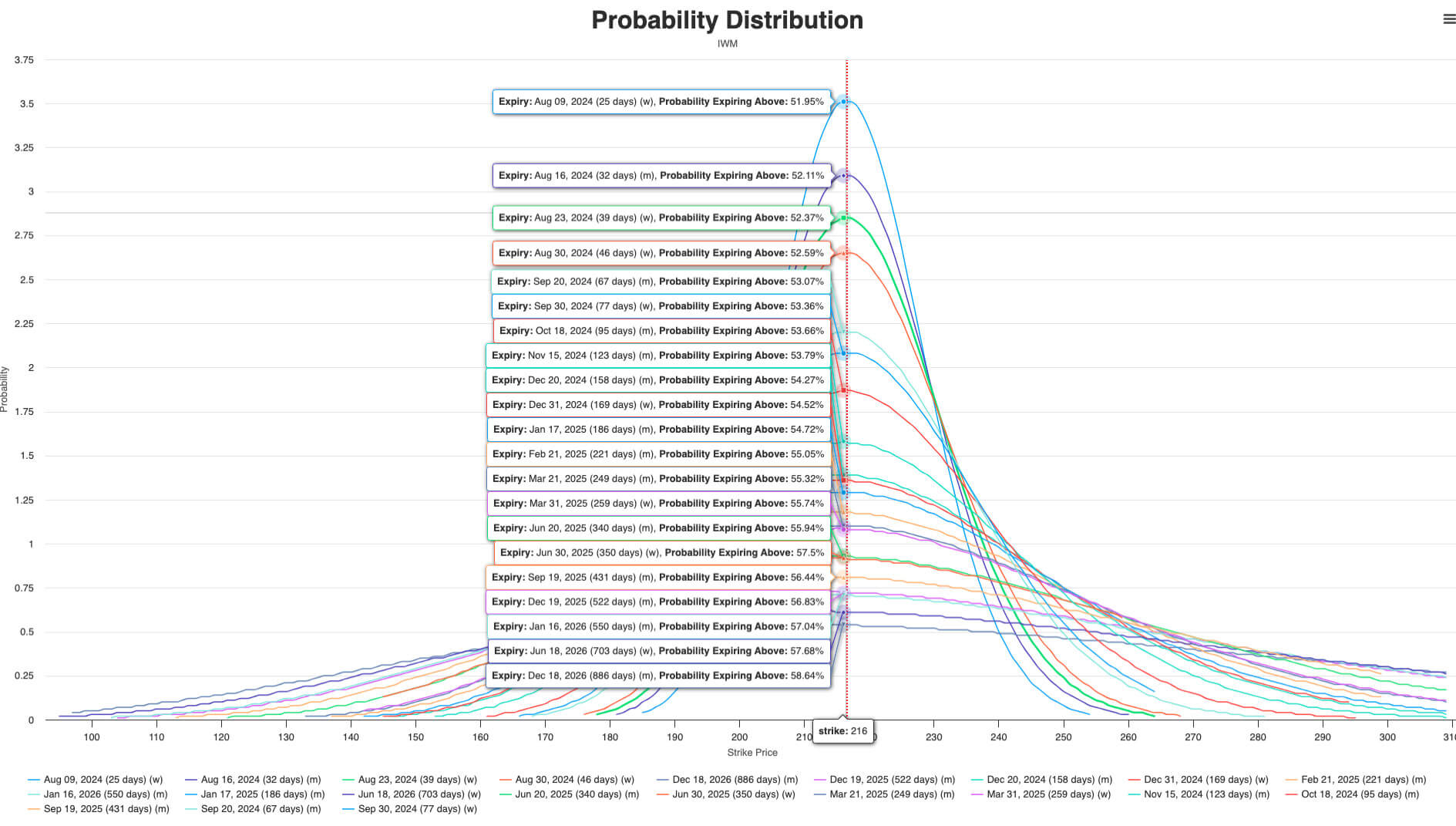

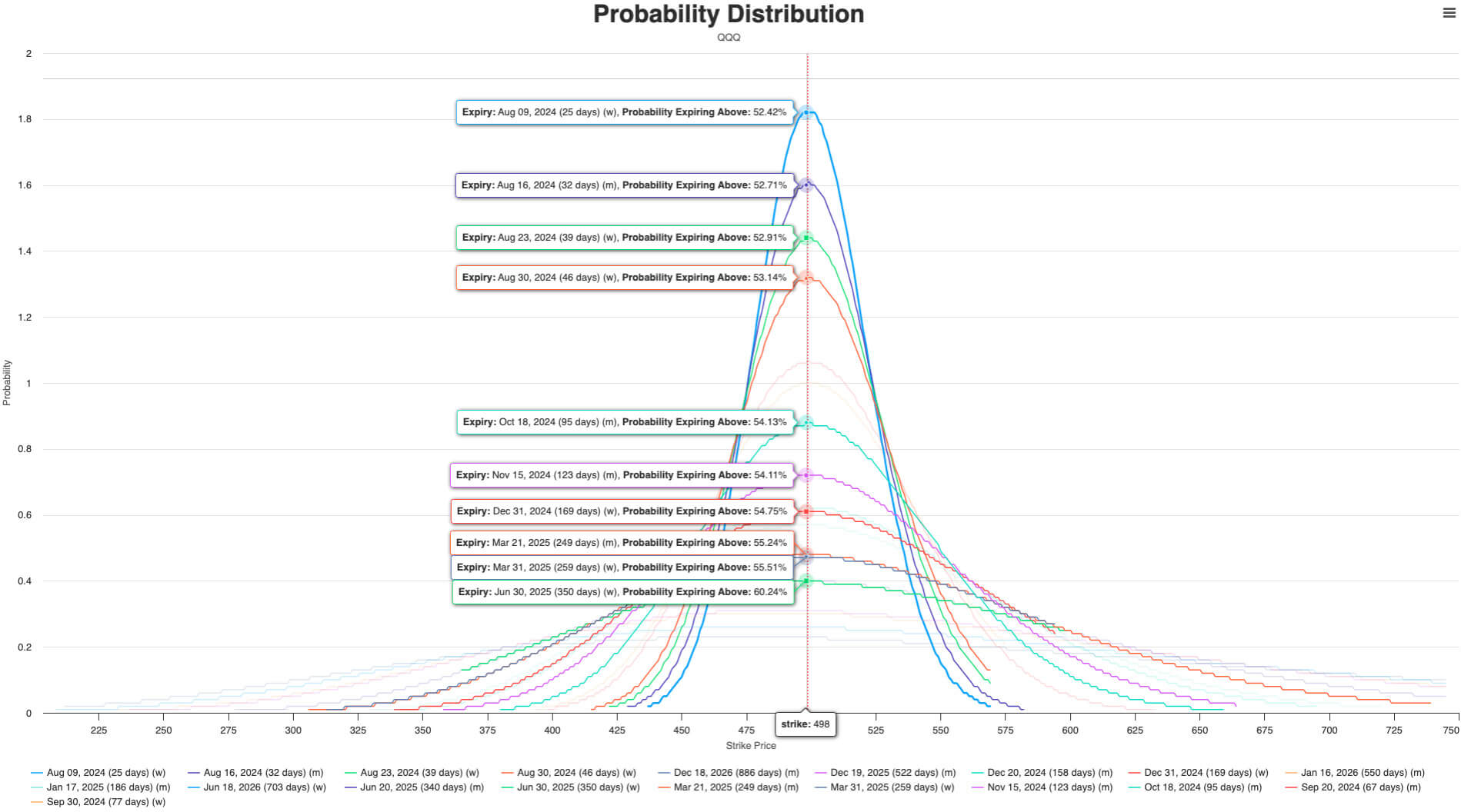

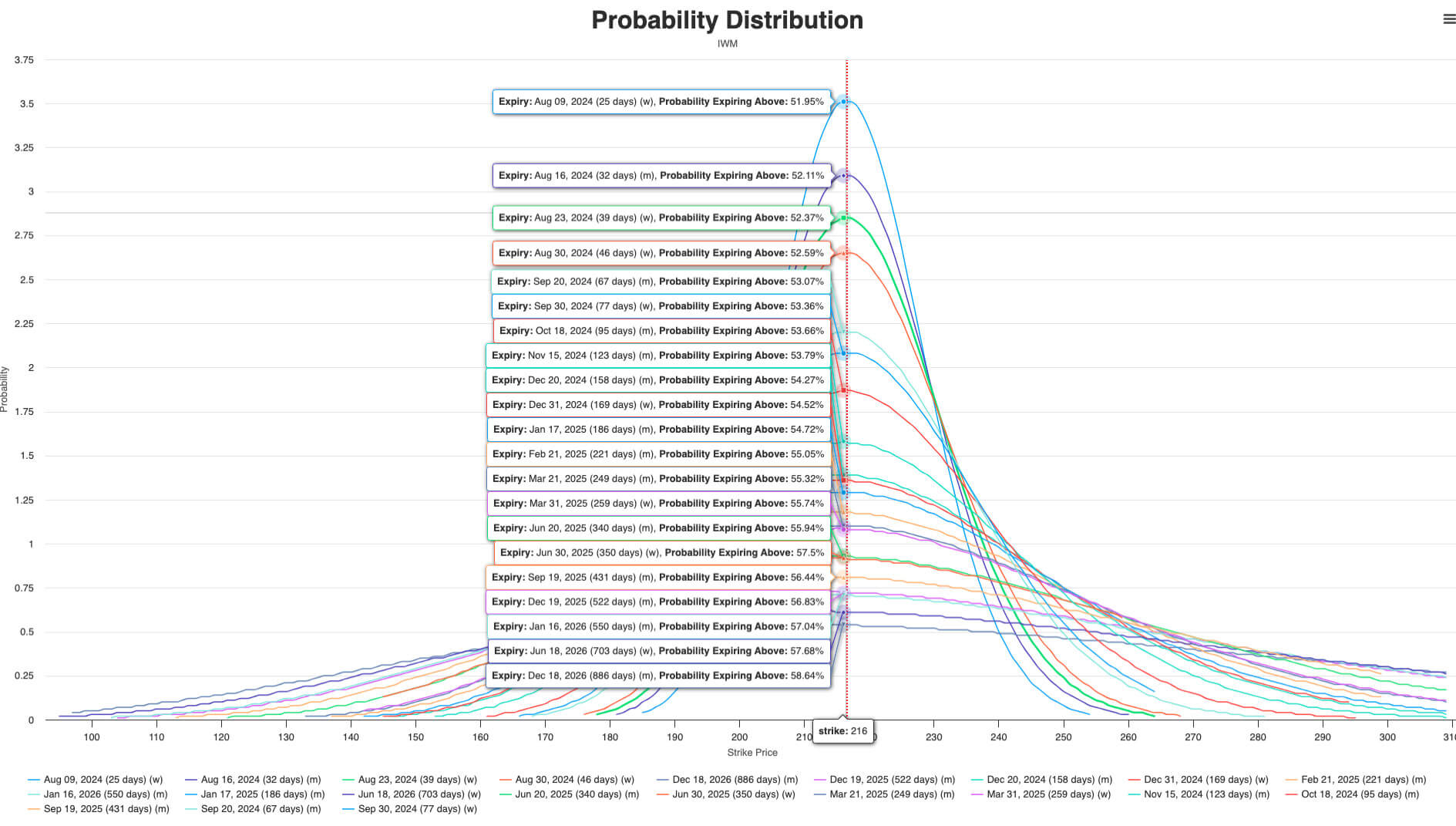

However, for small companies and tech companies, the potential impact of Trump’s tariff and immigration policies on their operations is obvious. Of course, this is also reflected in the implied expectations of the market: whether it is Nasdaq or Russell 2000, their implied return and implied increase are significantly lower than those of the S&P 500.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/probability-qqq.jpg" alt width="1899" height="1056" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/probability-qqq.jpg 1899w, https://cryptoslate.com/wp-content/uploads/2024/07/probability-qqq-300x167.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/probability-qqq-1024x569.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/probability-qqq-768x427.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/probability-qqq-1536x854.jpg 1536w" data-sizes="(max-width: 1899px) 100vw, 1899px" />Invesco QQQ Trust Series I (Nasdaq-100) far-month options implied probability distribution, as of Jul 16, 2024. Source: optioncharts.io

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/iwm.jpg" alt width="1889" height="1071" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/iwm.jpg 1889w, https://cryptoslate.com/wp-content/uploads/2024/07/iwm-300x170.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/iwm-1024x581.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/iwm-768x435.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/iwm-1536x871.jpg 1536w" data-sizes="(max-width: 1889px) 100vw, 1889px" />Implied probability distribution of iShares Russell 2000 ETF far-month options, as of Jul 16, 2024. Source: optioncharts.io

Overall, more interest rate cuts are expected to be relatively favourable for the stock market performance in the coming months. However, considering possible macro policy changes, holding only stock exposure does not seem to be the best choice. So, which asset exposures may bring more excess returns?

Commodities vs Cryptocurrency: King vs Queen

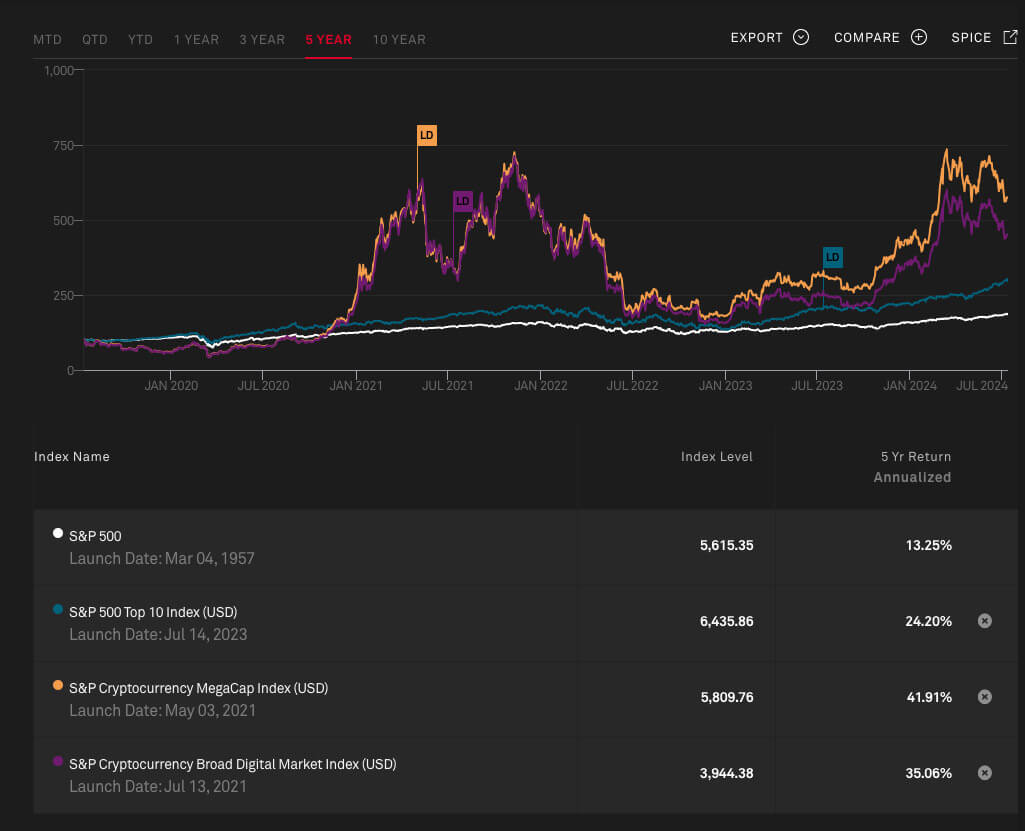

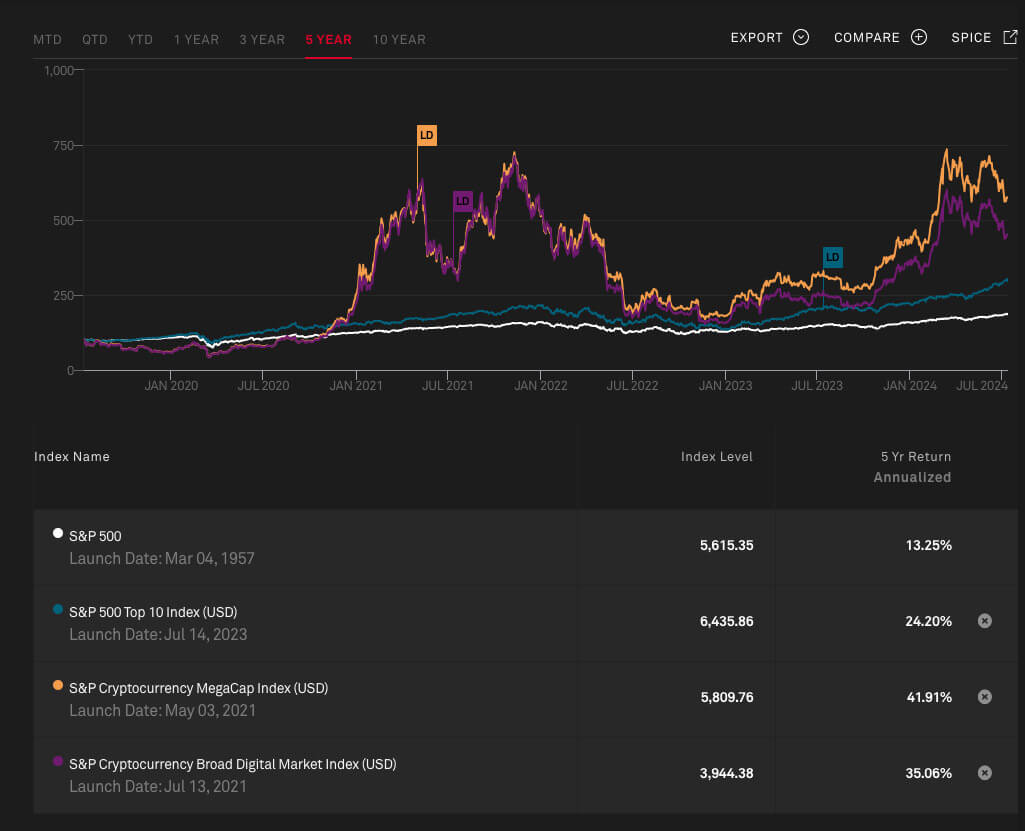

Compared to stocks, holding cryptocurrency exposure seems to have been proven to be a better choice during the interest rate cut cycle. Since the last round of the crypto bull market, the overall performance of cryptos has significantly surpassed the performance of the S&P 500. Even if you choose to hold mega stocks, their performance has lagged considerably behind BTC and ETH.

That is also why cryptocurrency-related exposure is rapidly occupying a higher proportion in investment portfolios: a small amount of cryptocurrency exposure can improve the portfolio’s overall performance during the bull market. In addition, when macro risk events occur, mainstream crypto assets such as BTC can play a certain hedging role—whether it is assassination or war.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/index.jpg" alt width="1025" height="831" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/index.jpg 1025w, https://cryptoslate.com/wp-content/uploads/2024/07/index-300x243.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/index-768x623.jpg 768w" data-sizes="(max-width: 1025px) 100vw, 1025px" />Comparison of crypto assets’ returns and S&P 500 returns, as of Jul 16, 2024. Source: S&P Global

However, cryptos still face competition from other non-equity assets, such as commodities. Unlike cryptocurrency, commodities have maintained a relatively strong performance during the interest rate hike cycle. Excess onshore and offshore cash liquidity is one of the core factors maintaining commodities’ performance; due to previous years’ QE and changes in US monetary policies, both onshore and offshore markets have accumulated a large amount of US dollar liquidity.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/performance-comparison.jpg" alt width="1040" height="666" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/performance-comparison.jpg 1040w, https://cryptoslate.com/wp-content/uploads/2024/07/performance-comparison-300x192.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/performance-comparison-1024x656.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/performance-comparison-768x492.jpg 768w" data-sizes="(max-width: 1040px) 100vw, 1040px" />Performance comparison between mainstream cryptos and overall commodities, as of Jul 16, 2024. Source: S&P Global

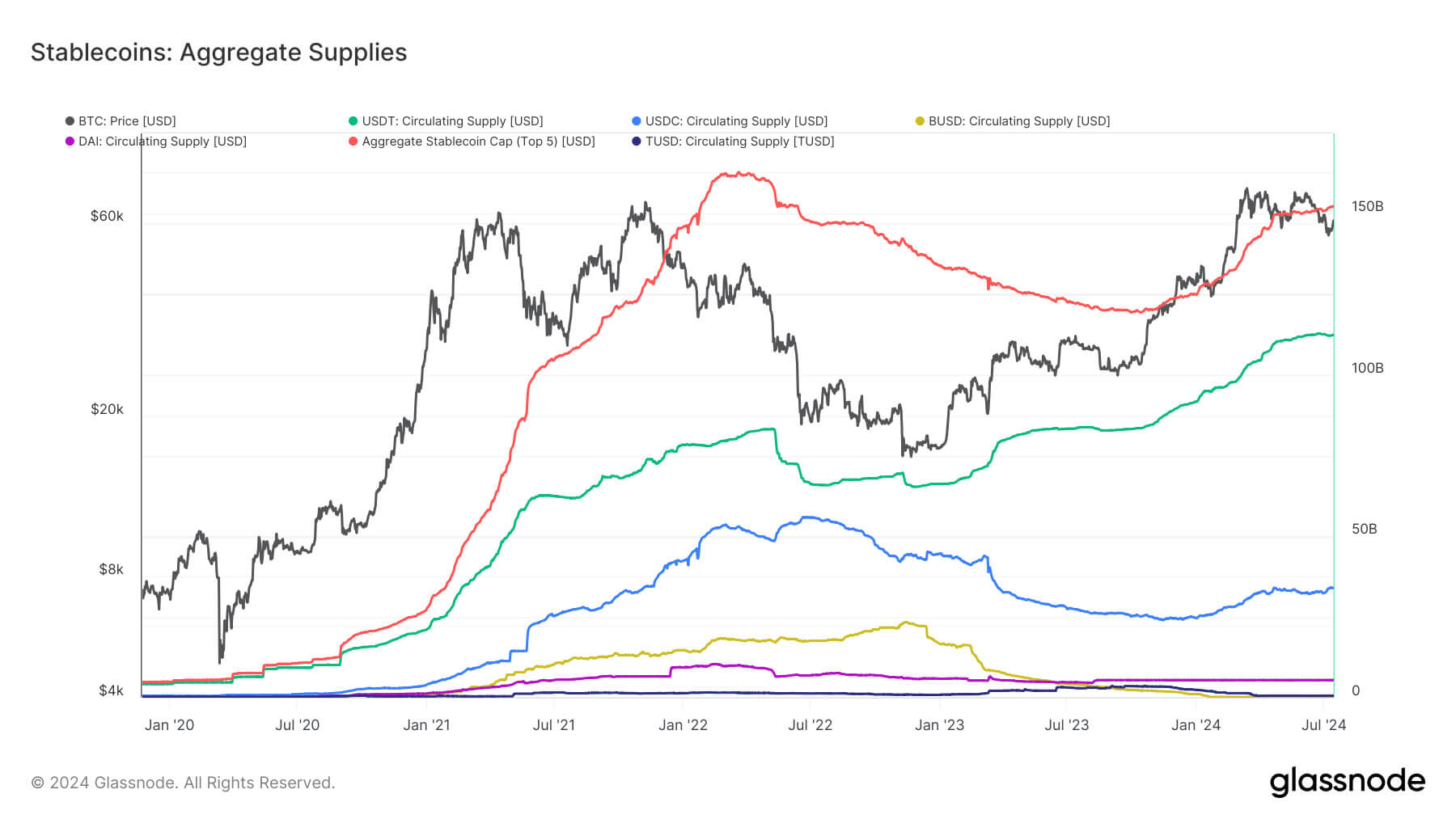

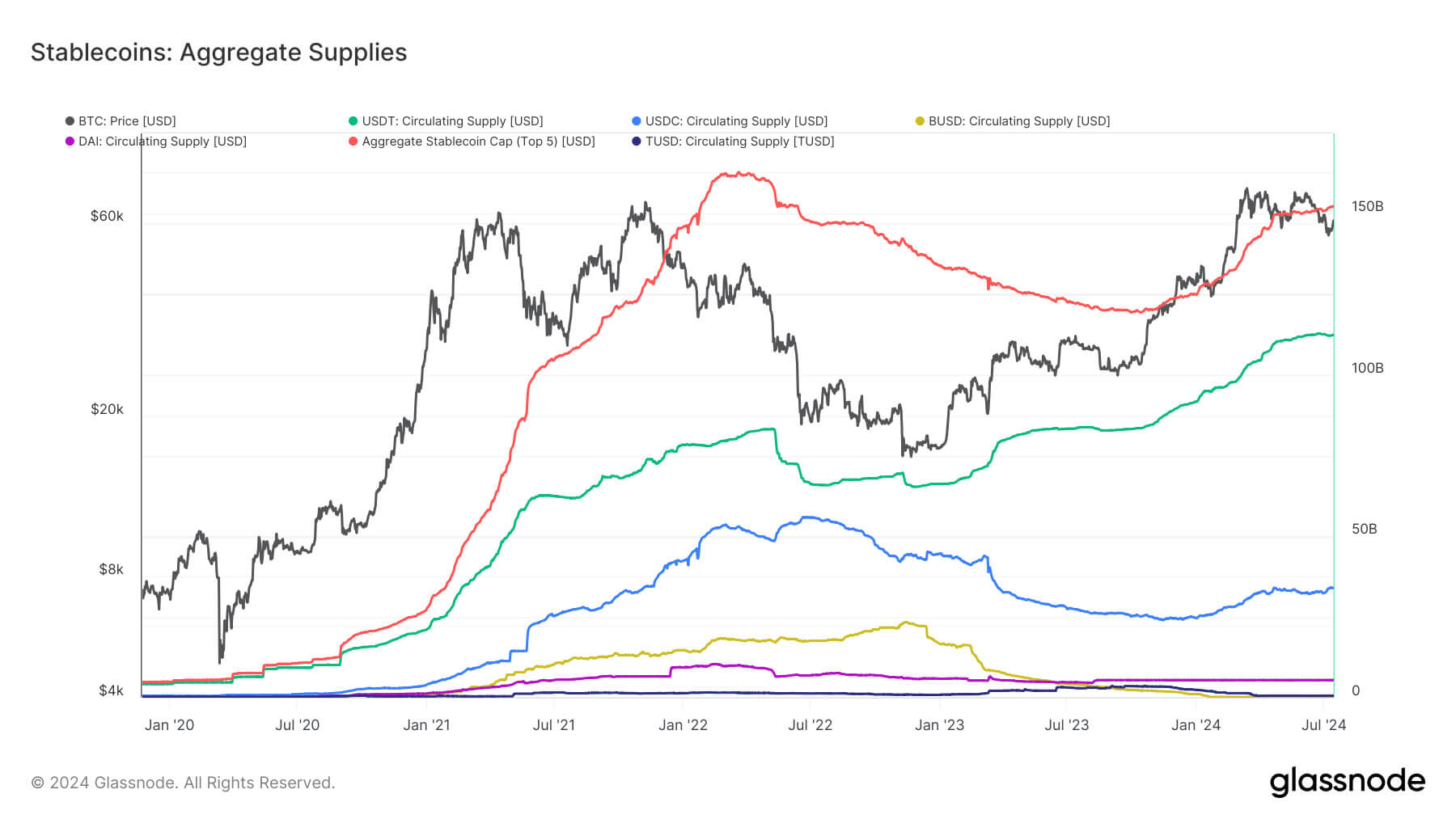

In the cryptocurrency market alone, over $150 billion in cash liquidity is already circulating in the form of stablecoins, and the scale is expected to continue to increase. In the traditional market, the scale of the Eurodollar used for commodity trade is much larger than that of the crypto market. Considering the impact of Trump’s future tariff policies, the increase in trade costs will be reflected in the prices of commodity futures, which may continue the strong performance of commodities. It is not difficult to observe that from 2021 to now, whether it is interest rate cuts or interest rate hikes, the performance of commodities is not inferior to cryptocurrency. Considering the size and volume of the commodity market, this cannot be ignored.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/stablecoins-aggregate-supplies.jpg" alt width="1800" height="1013" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/stablecoins-aggregate-supplies.jpg 1800w, https://cryptoslate.com/wp-content/uploads/2024/07/stablecoins-aggregate-supplies-300x169.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/stablecoins-aggregate-supplies-1024x576.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/stablecoins-aggregate-supplies-768x432.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/stablecoins-aggregate-supplies-1536x864.jpg 1536w" data-sizes="(max-width: 1800px) 100vw, 1800px" />As of Jul 16, 2024, changes in stablecoins supply in the crypto market. Source: Glassnode

Let’s consider something more profound: the rapid expansion of the Eurodollar has led to the production and flow of commodities gradually lagging behind the expansion of liquidity scale, and interest rate cuts will undoubtedly accelerate the process of liquidity scale expansion. At this time, commodity prices denominated in US dollars will remain stable at a high level for a long time.

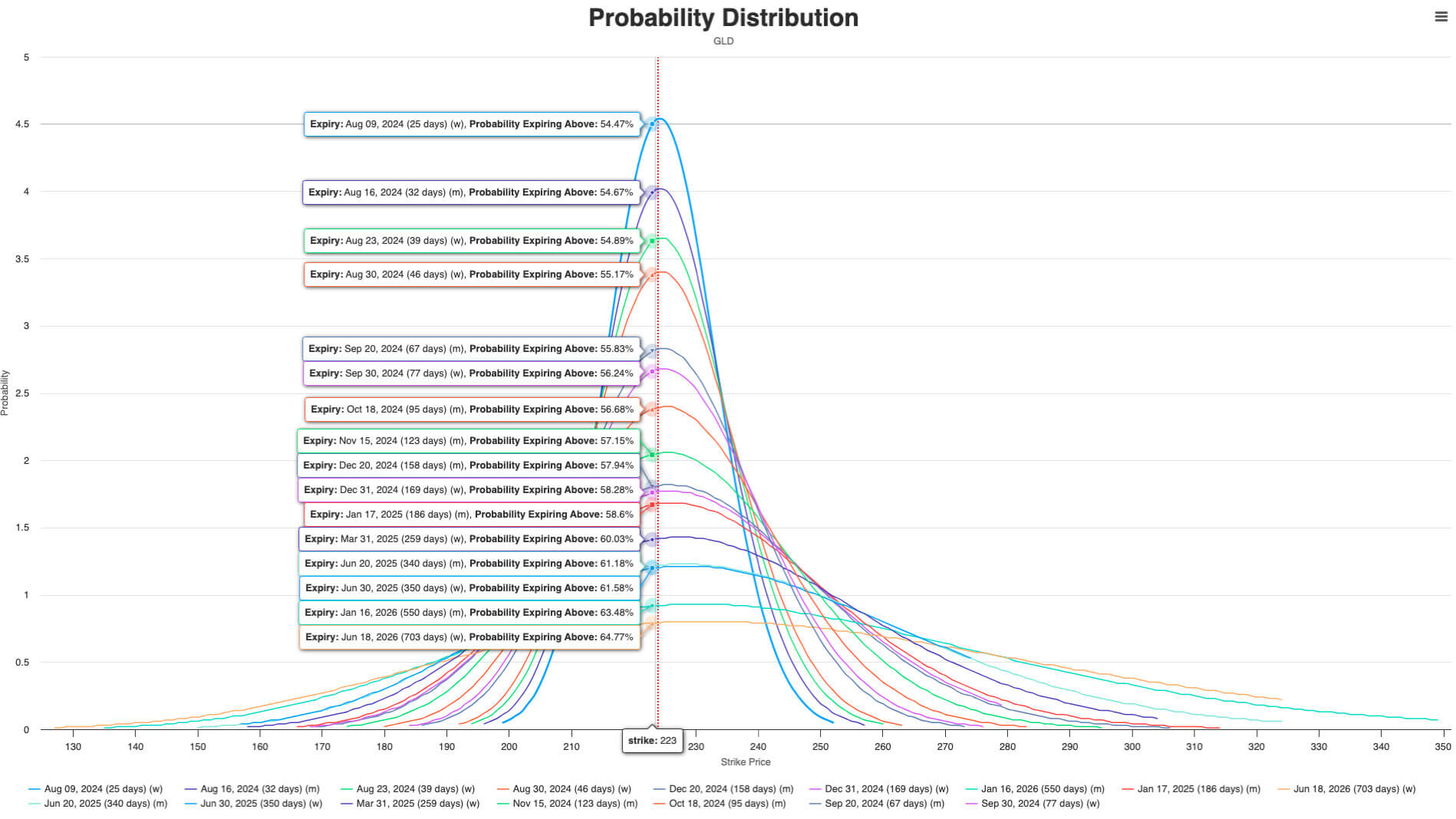

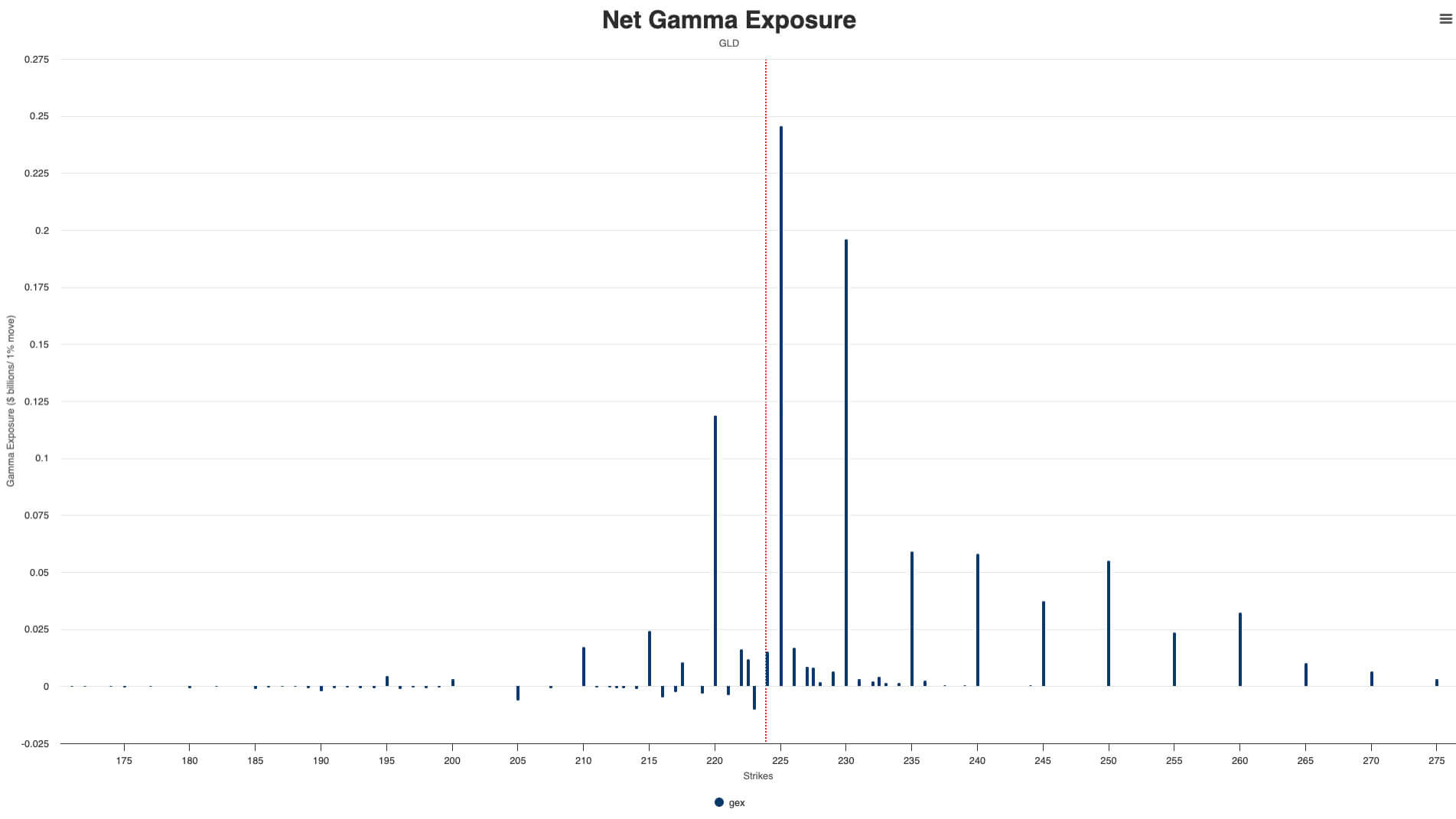

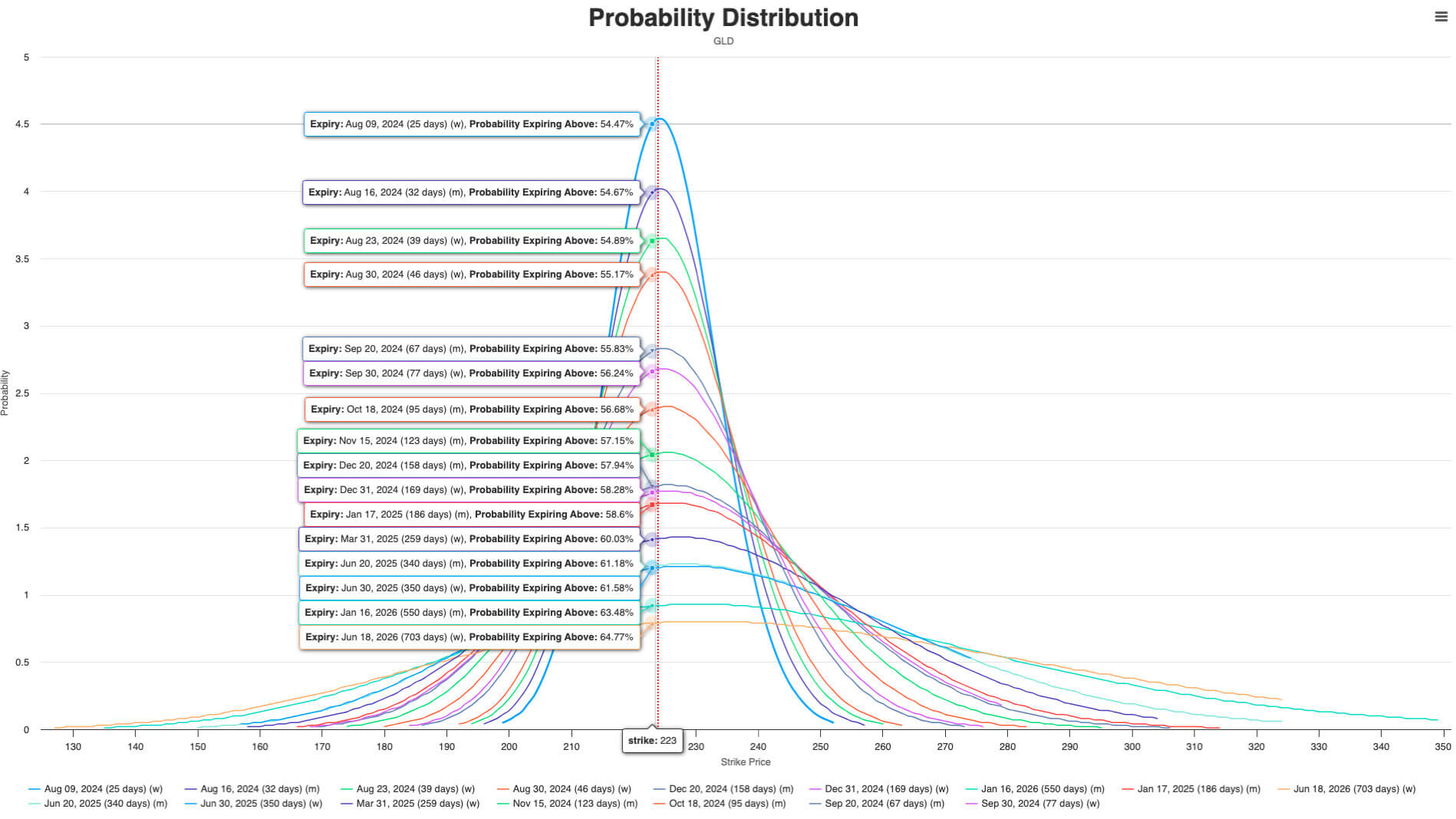

Although commodity prices may experience a short-term correction, from a medium to long-term perspective, the upward trend of commodities will not show significant changes. In addition, relatively scarce commodities such as gold can also play the role of “hard currency” and “liquidity container”; in the liquidity easing cycle, commodities may become strong competitors of cryptos.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/gld.jpg" alt width="1898" height="1068" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/gld.jpg 1898w, https://cryptoslate.com/wp-content/uploads/2024/07/gld-300x169.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/gld-1024x576.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/gld-768x432.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/gld-1536x864.jpg 1536w" data-sizes="(max-width: 1898px) 100vw, 1898px" />SPDR Gold Shares (GLD) far-month options’ implied probability distribution, as of Jul 16, 2024. Source: optioncharts.io

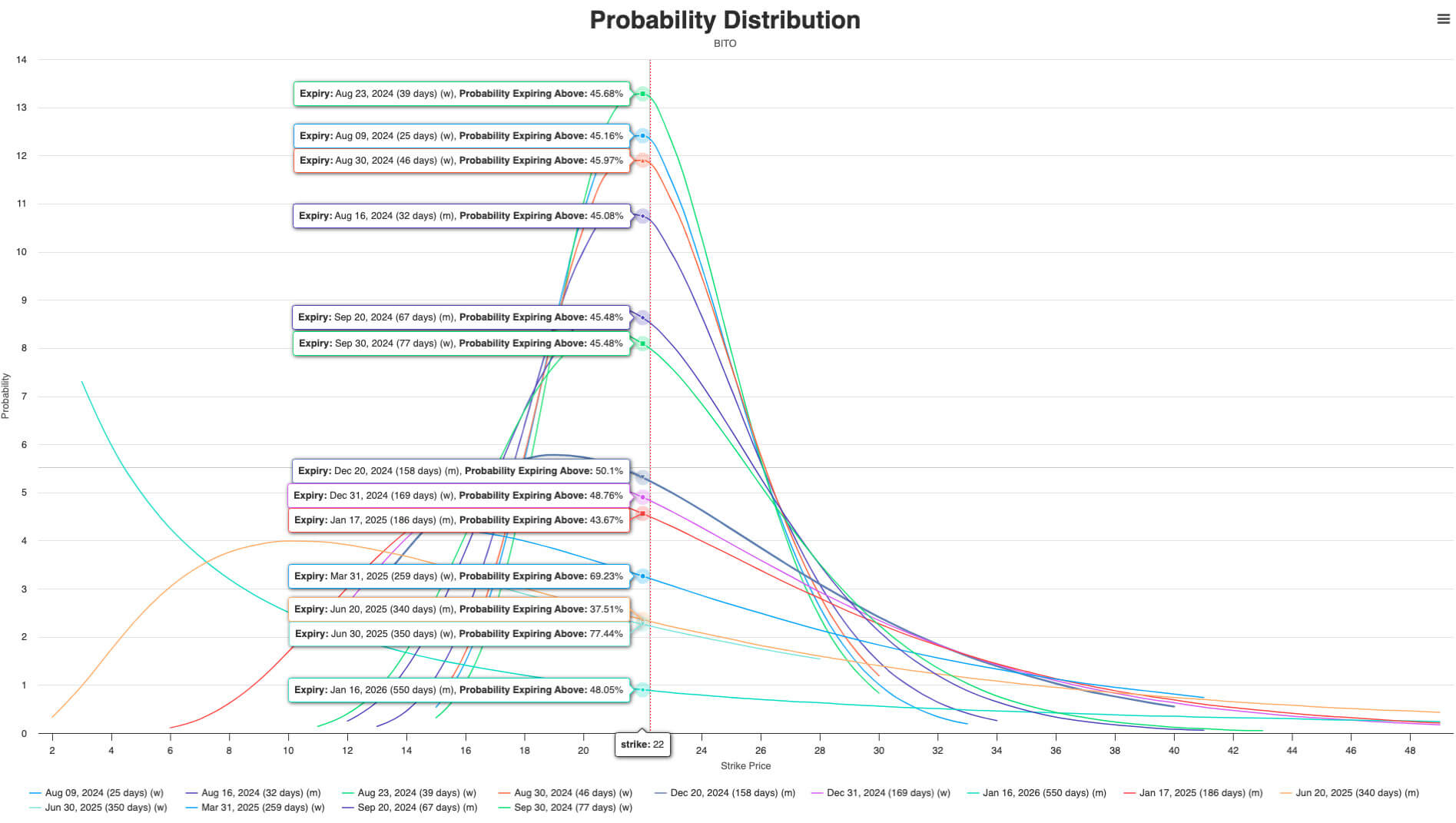

Of course, the crypto market also has its unique advantages: higher macro sensitivity and higher leverage. Compared with commodities, crypto derivatives significantly impact the market, which brings relatively higher volatility, thus bringing better potential returns to investors in the upward cycle. However, higher leverage also means greater risk. In summary, commodities and cryptocurrencies are “optional” other than stocks, and the share of the two in the portfolio depends more on investors’ risk preferences.

So, Back to the Crypto Market…

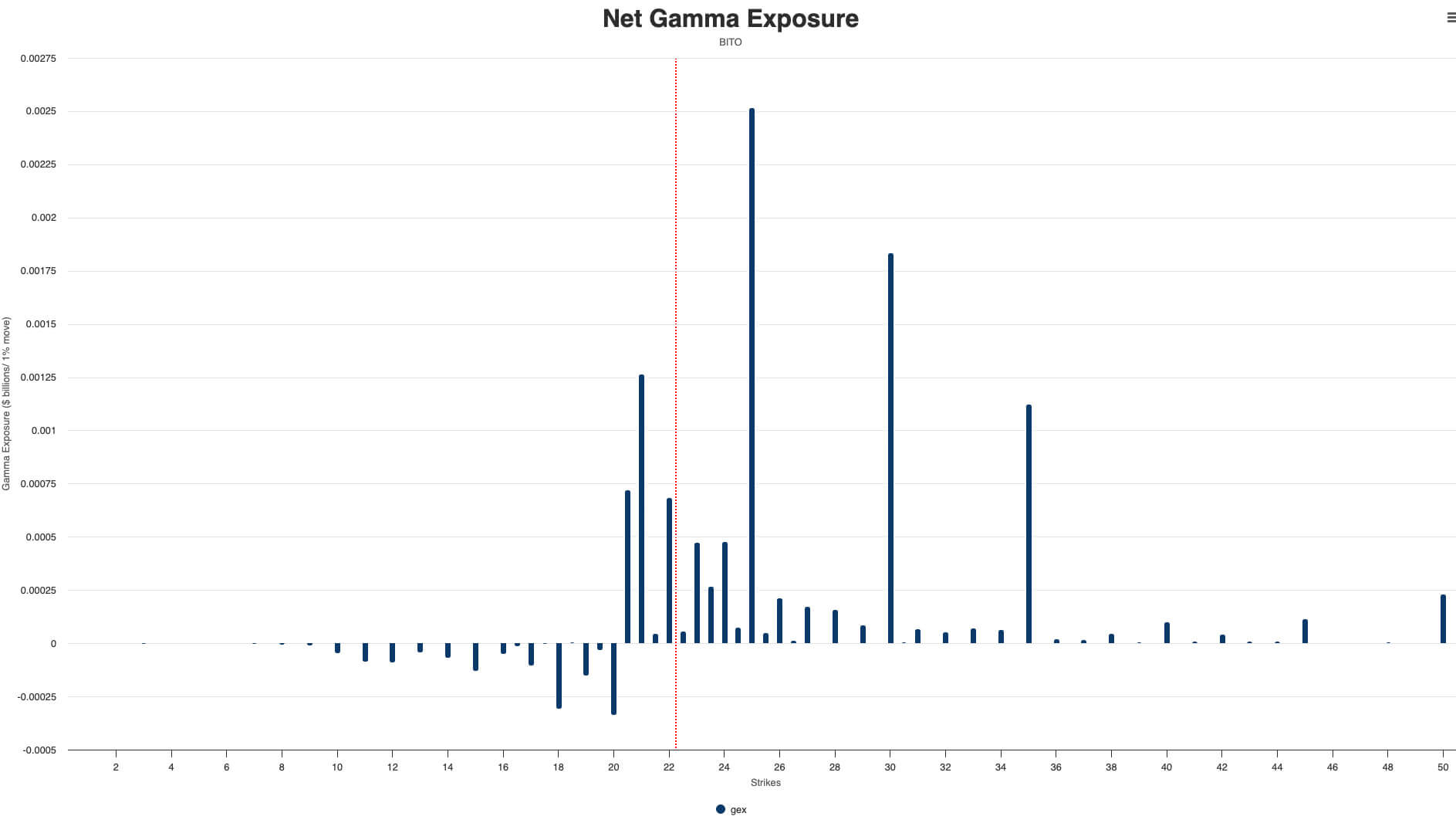

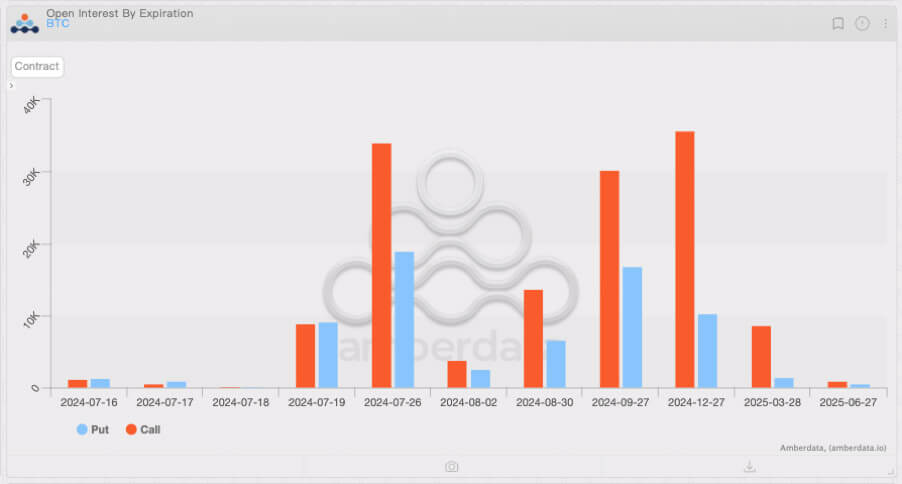

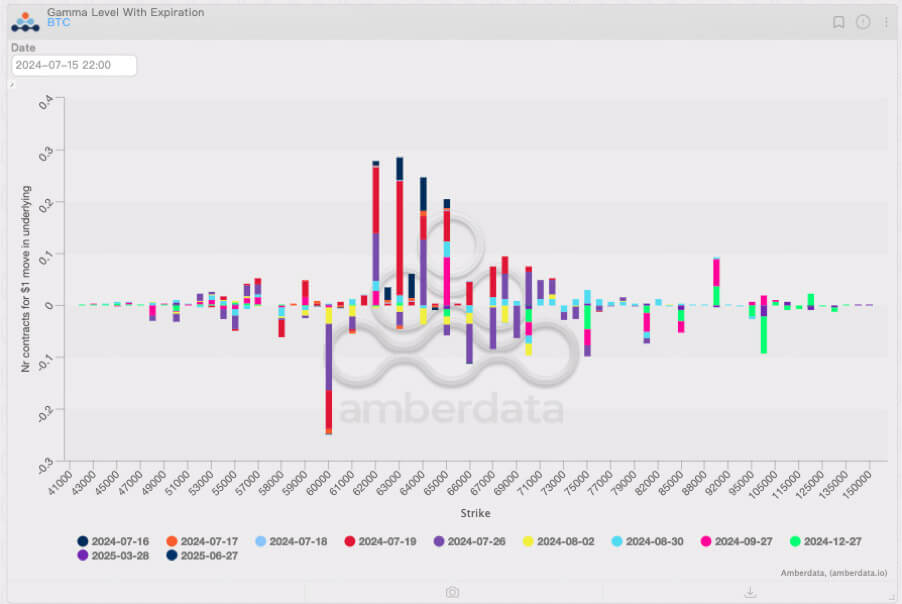

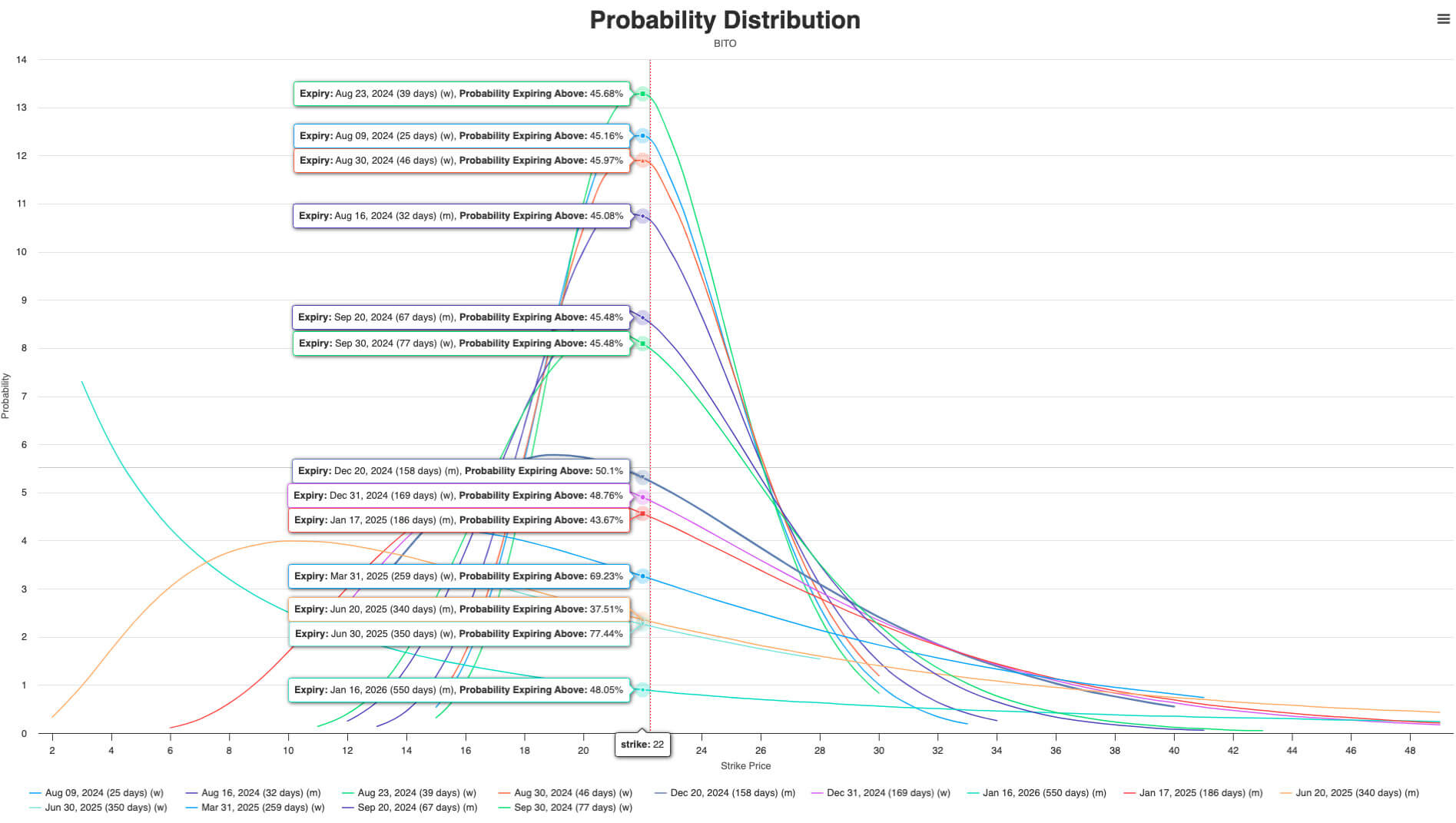

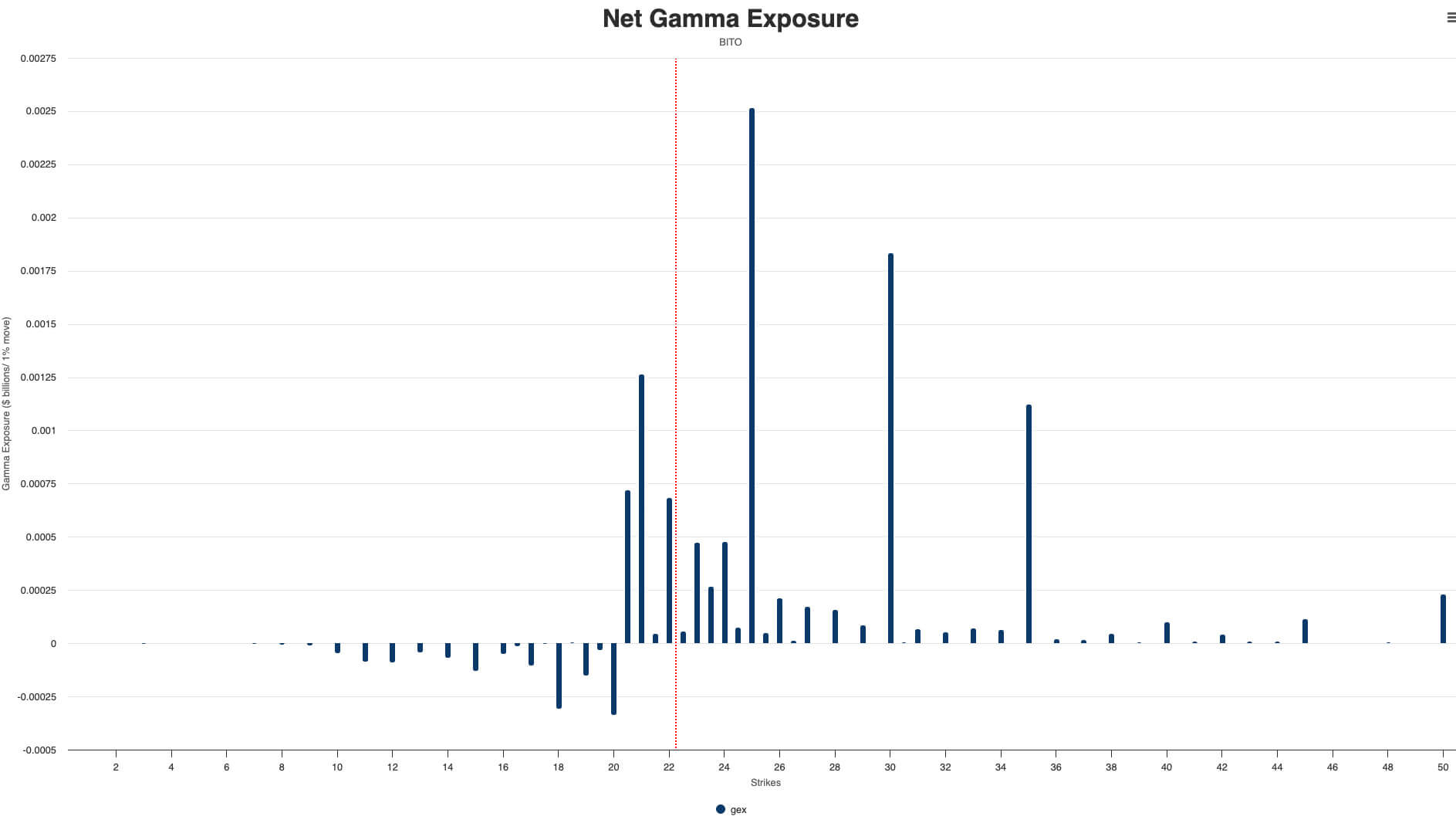

Is cryptocurrency better than commodities in the next 1-2 months? The answer is “not sure” – at least for BTC. Investors in the US stock market and cryptocurrency market seem to have reached an implicit consensus: BTC is facing more resistance from market makers hedging and investors profit-taking on its further upward path, reducing investors’ expectations for further price increases in BTC. From the implied probability distribution perspective, the probability of BTC price further breaking through in the next month has dropped to below 46%. In comparison, gold still has a probability of over 54% to continue to rise further through new highs.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/bito.jpg" alt width="1895" height="1071" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/bito.jpg 1895w, https://cryptoslate.com/wp-content/uploads/2024/07/bito-300x170.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/bito-1024x579.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/bito-768x434.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/bito-1536x868.jpg 1536w" data-sizes="(max-width: 1895px) 100vw, 1895px" />BITO far-month options implied probability distribution, as of Jul 16, 2024. Source: optioncharts.io

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-bito.jpg" alt width="1887" height="1066" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-bito.jpg 1887w, https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-bito-300x169.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-bito-1024x578.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-bito-768x434.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-bito-1536x868.jpg 1536w" data-sizes="(max-width: 1887px) 100vw, 1887px" />BITO’s net gamma exposure distribution, as of Jul 16, 2024. Source: optioncharts.io

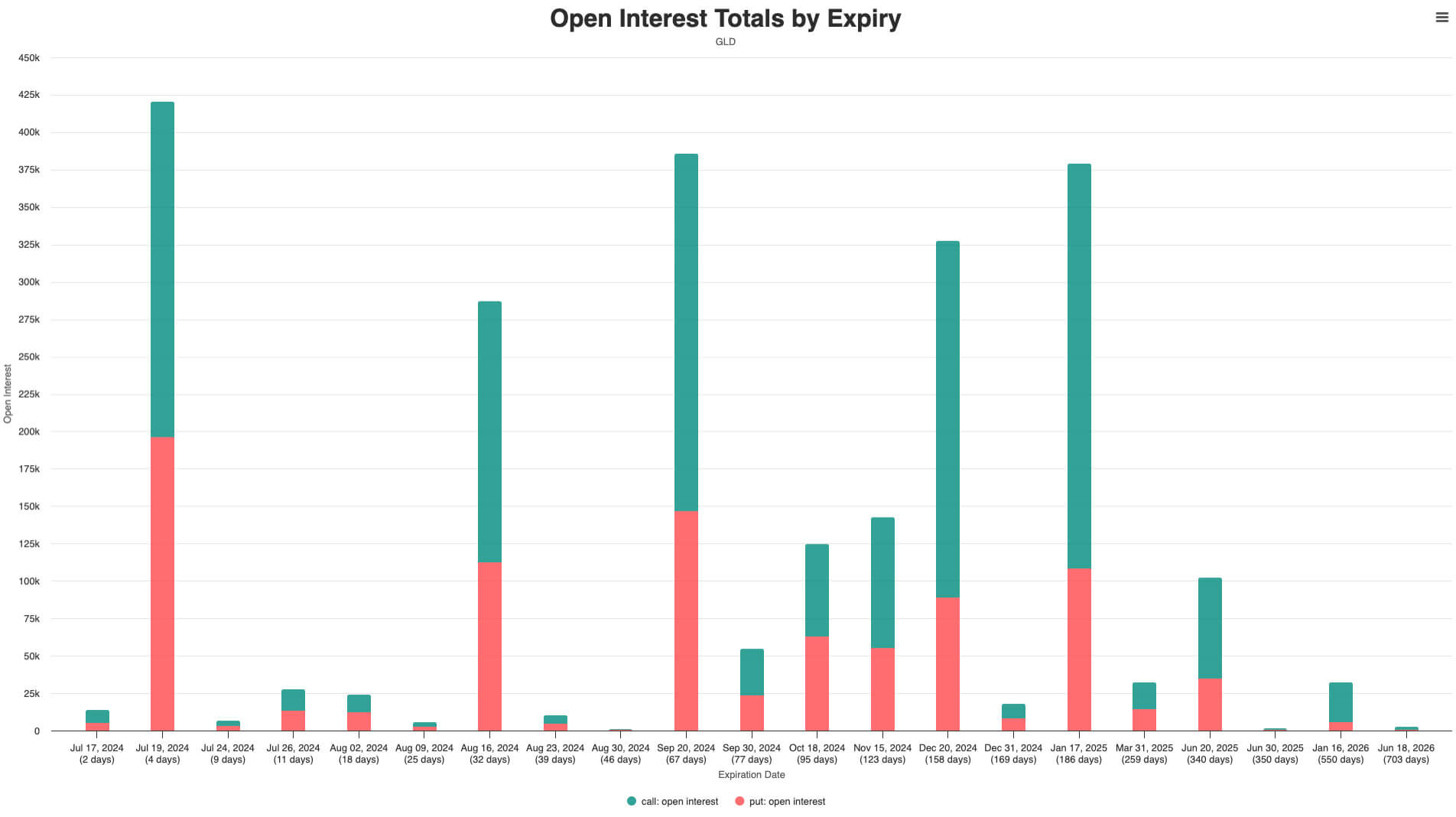

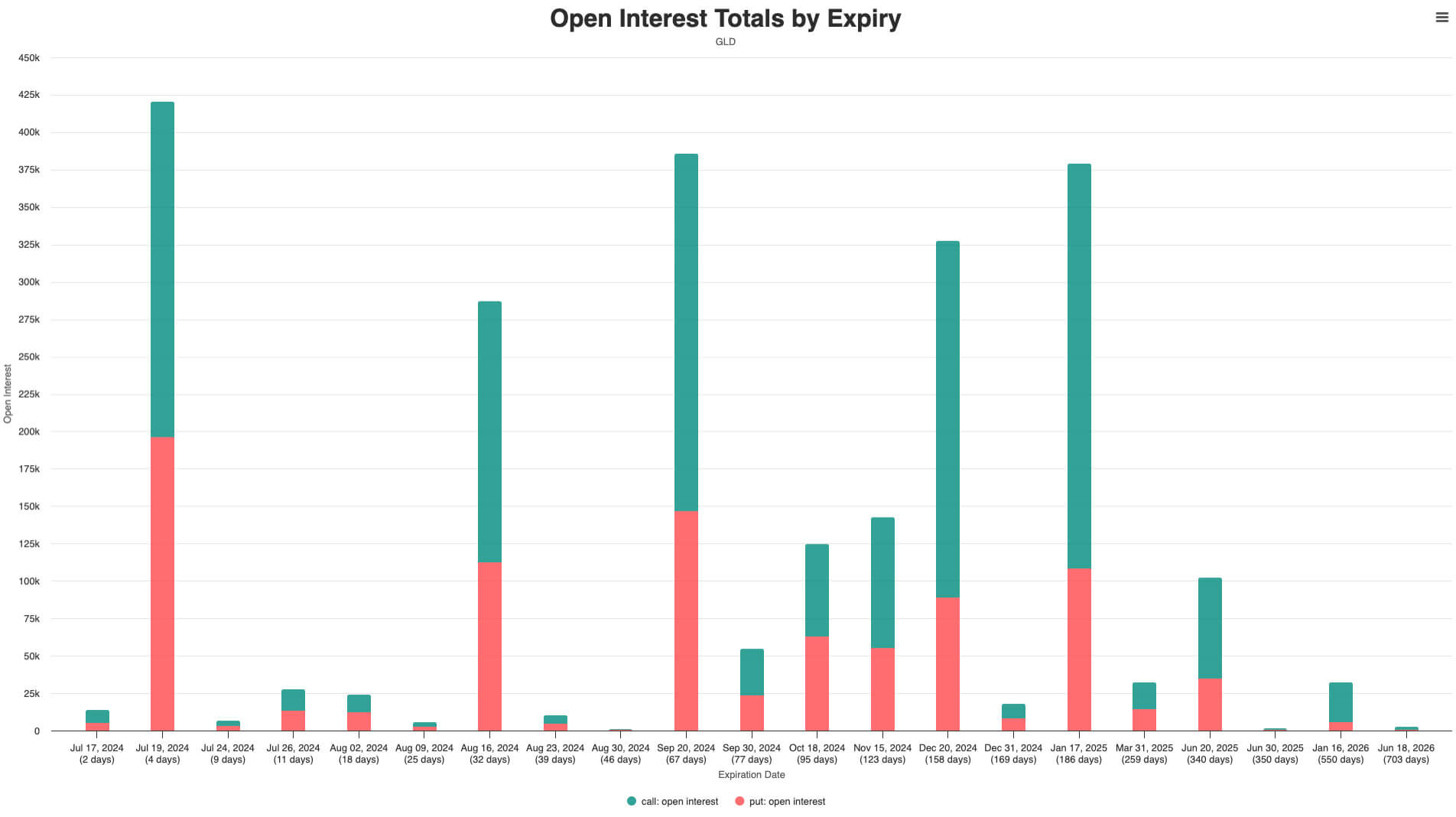

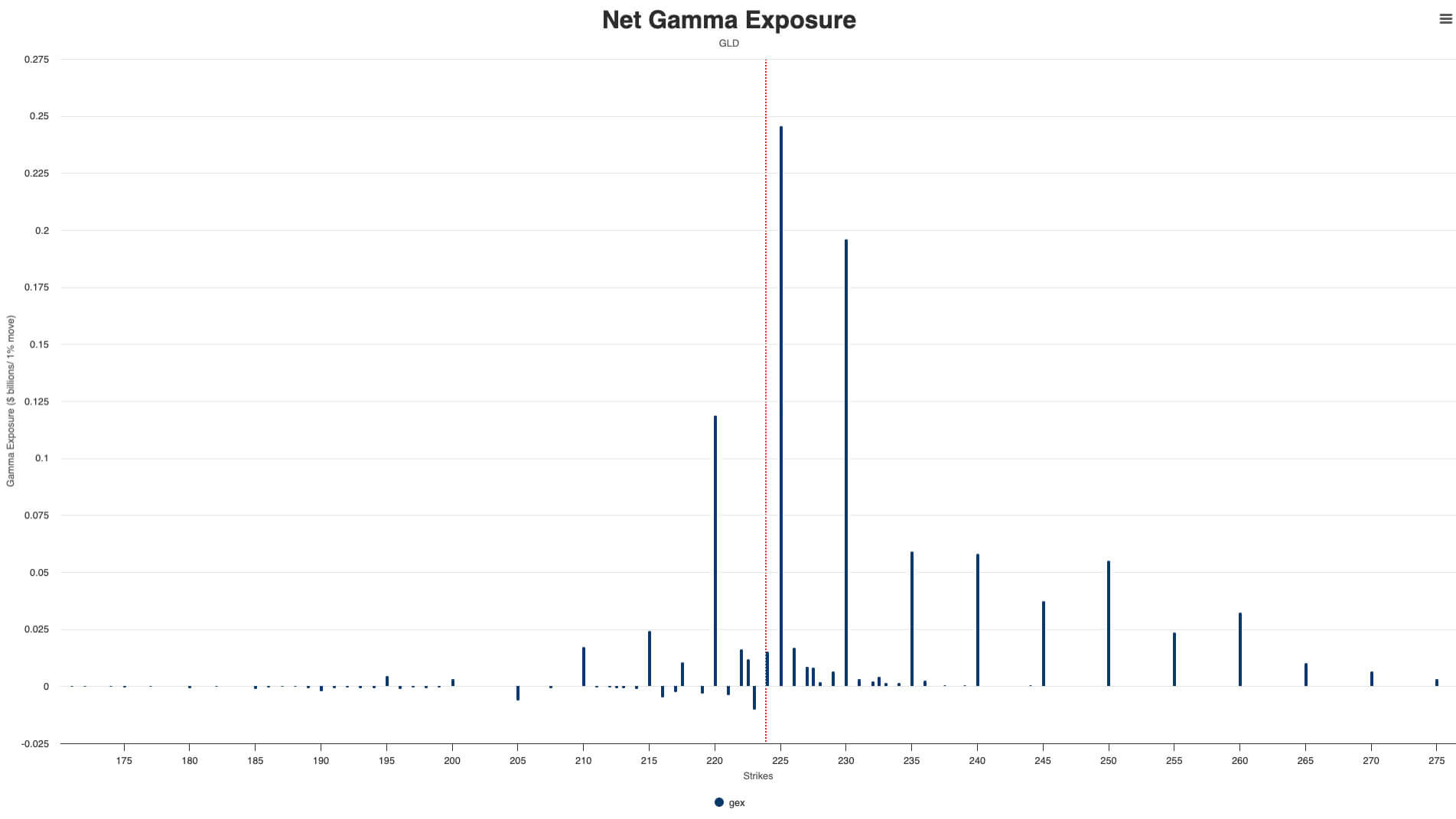

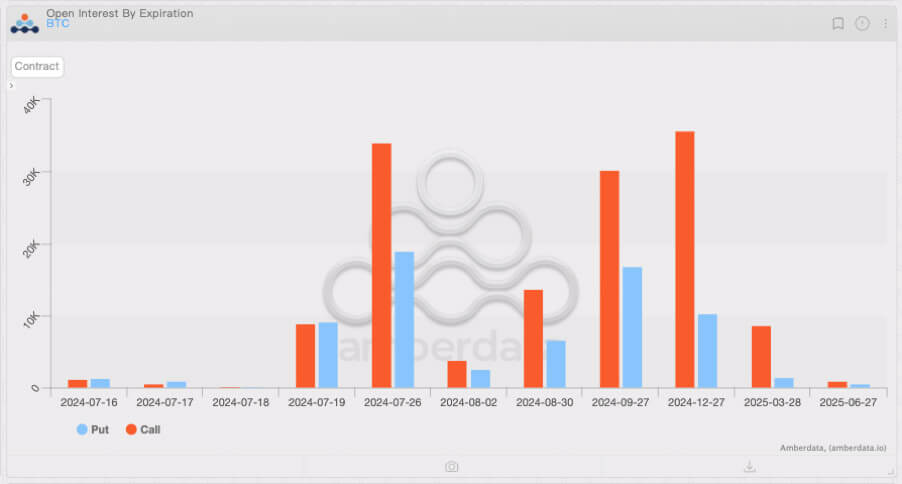

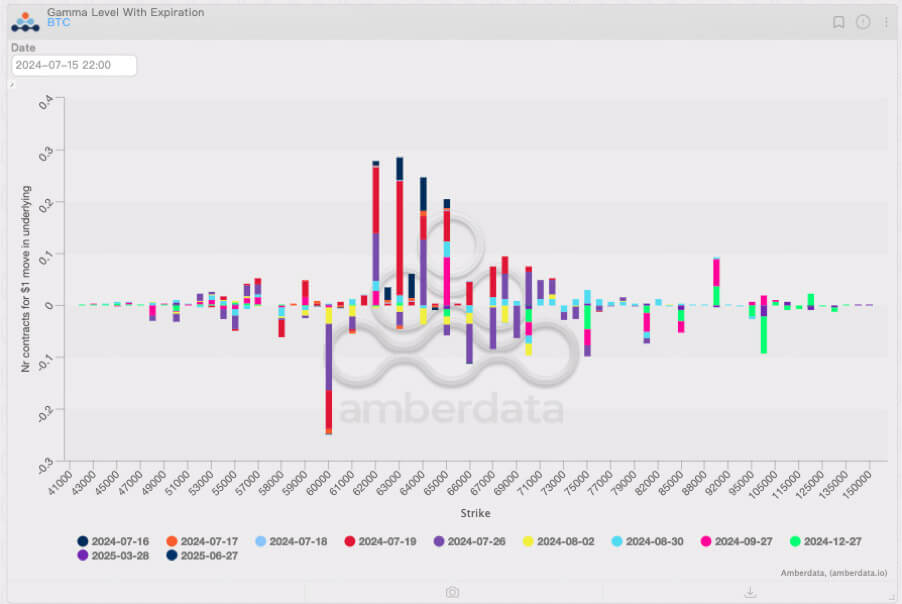

Indeed, the resistance on the upward path of gold is also significant. However, comparing the option open interest distribution of GLD and BTC, it is not difficult to find that after July 19th, the upward resistance of gold prices mostly comes from the far month rather than the front month, which means that gold prices will face relatively small upward resistance in the next few weeks. In contrast, the front-month resistance of BTC accounts for a larger proportion, which means that the possibility of a breakthrough in the next few weeks will further decrease. The price breakthrough of BTC may occur in Aug, but not now.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/open-interest-gold.jpg" alt width="1904" height="1068" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/open-interest-gold.jpg 1904w, https://cryptoslate.com/wp-content/uploads/2024/07/open-interest-gold-300x168.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/open-interest-gold-1024x574.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/open-interest-gold-768x431.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/open-interest-gold-1536x862.jpg 1536w" data-sizes="(max-width: 1904px) 100vw, 1904px" />BITO options open interest distribution, as of Jul 16, 2024. Source: optioncharts.io

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-gld.jpg" alt width="1903" height="1071" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-gld.jpg 1903w, https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-gld-300x169.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-gld-1024x576.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-gld-768x432.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/net-gamma-gld-1536x864.jpg 1536w" data-sizes="(max-width: 1903px) 100vw, 1903px" />GLD’s net gamma exposure distribution, as of Jul 16, 2024. Source: optioncharts.io

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/distribution-deribit-btc.jpg" alt width="902" height="484" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/distribution-deribit-btc.jpg 902w, https://cryptoslate.com/wp-content/uploads/2024/07/distribution-deribit-btc-300x161.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/distribution-deribit-btc-768x412.jpg 768w" data-sizes="(max-width: 902px) 100vw, 902px" />Distribution of Deribit BTC options open interest, as of Jul 16, 2024. Source: Amberdata Derivatives

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-btc.jpg" alt width="902" height="604" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-btc.jpg 902w, https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-btc-300x201.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-btc-768x514.jpg 768w" data-sizes="(max-width: 902px) 100vw, 902px" />Deribit BTC options gamma exposure distribution, as of Jul 16, 2024. Source: Amberdata Derivatives

However, once a breakthrough occurs, the hedging effect of market makers will reverse and push the price of BTC to rise sharply. Although this is a low-probability event, holding some long positions in the far month is still a more appropriate choice; the short-term consolidation of BTC does not affect its long-term rise in the low interest rate environment in the future.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/skew.jpg" alt width="1332" height="605" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/skew.jpg 1332w, https://cryptoslate.com/wp-content/uploads/2024/07/skew-300x136.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/skew-1024x465.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/skew-768x349.jpg 768w" data-sizes="(max-width: 1332px) 100vw, 1332px" />Deribit BTC options far-month skewness changes, as of Jul 16, 2024. Source: Amberdata Derivatives

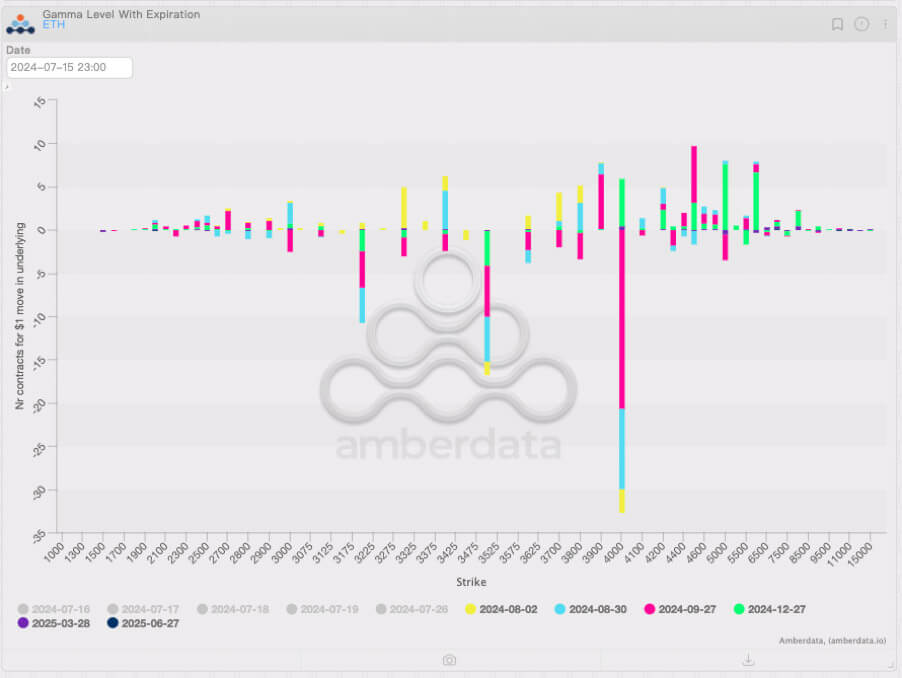

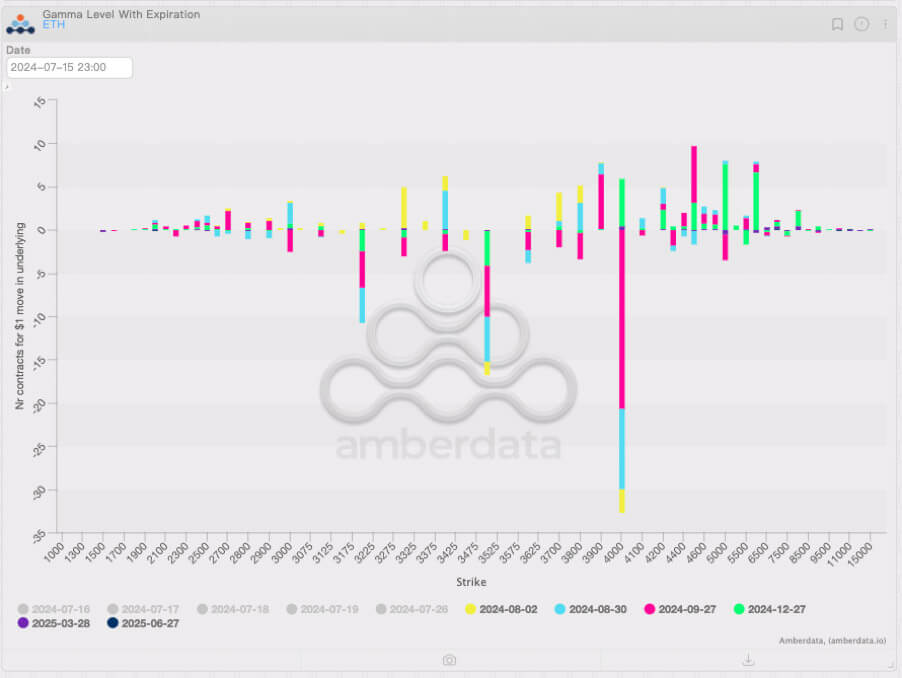

For ETH, we can expect it to perform better than BTC. On the one hand, ETH spot ETF may be officially listed for trading next week; during the Asset Allocation period, ETH may experience a similar rise to BTC in Quarter 1, which makes investors have higher expectations for ETH’s performance. From the gamma distribution perspective, ETH’s resistance on the upward path may be significantly reduced after the Jul options’ expiration, which means its price breakthrough will be more certain.

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/deribith-eth.jpg" alt width="1775" height="696" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/deribith-eth.jpg 1775w, https://cryptoslate.com/wp-content/uploads/2024/07/deribith-eth-300x118.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/deribith-eth-1024x402.jpg 1024w, https://cryptoslate.com/wp-content/uploads/2024/07/deribith-eth-768x301.jpg 768w, https://cryptoslate.com/wp-content/uploads/2024/07/deribith-eth-1536x602.jpg 1536w" data-sizes="(max-width: 1775px) 100vw, 1775px" />Deribit ETH options far-month skewness changes, as of Jul 16, 2024. Source: Amberdata Derivatives

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-eth.jpg" alt width="902" height="674" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-eth.jpg 902w, https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-eth-300x224.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-eth-768x574.jpg 768w" data-sizes="(max-width: 902px) 100vw, 902px" />Distribution of gamma exposure of Deribit ETH options, as of Jul 16, 2024. Source: Amberdata Derivatives

" data-src="https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-eth-options.jpg" alt width="902" height="678" data-srcset="https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-eth-options.jpg 902w, https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-eth-options-300x225.jpg 300w, https://cryptoslate.com/wp-content/uploads/2024/07/gamma-level-eth-options-768x577.jpg 768w" data-sizes="(max-width: 902px) 100vw, 902px" />Deribit ETH options gamma exposure distribution (excluding Jul options), as of Jul 16, 2024. Source: Amberdata Derivatives

In summary, our asset allocation strategy for Jul and Aug is ready to set:

Stock positions are dominated by SPX bulls.Bond positions depend on personal preference.For commodities, consider increasing holdings of some gold bulls (achieved through GLD or CME’s gold futures).In terms of cryptocurrency, hold more long positions in ETH and moderately long positions in BTC.Increase the proportion of commodities and cryptocurrency in the investment portfolio appropriately (for risk-neutral investors, 5% is a more appropriate choice; for risk-seekers, consider increasing the proportion of commodities and cryptocurrency in positioning to 10%).

Let’s enjoy the appetizer before the interest rate cuts together; the feast is about to begin. Are you ready?

About BloFin Research

BloFin Research is the sub-brand of BloFin Academy‘s professional content. Based on the team’s rich experience and mature methodology in the traditional and crypto markets, BloFin Research is committed to providing leading & in-depth institution-level research content for global crypto investors. BloFin Research’s content has been widely recognized, cited and reposted by top institutions and media in the global market, including but not limited to Coindesk, Forbes, Yahoo Finance, Deribit Insights, CryptoSlate, Amberdata, Optioncharts, etc.

BloFin Official Website: https://www.blofin.com BloFin Twitter: https://x.com/Blofin_Official BloFin Academy: https://x.com/BloFin_Academy

Contact

Head of Marketing and Public Relations Annio Wu [email protected]zodiacbet

Mentioned in this article

" data-src="https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2024/06/blofin-logo.jpg&w=16&h=16&q=75" data-srcset="https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2024/06/blofin-logo.jpg&w=24&h=24&q=75 1.5x, https://cryptoslate.com/wp-content/themes/cryptoslate-2020/imgresize/timthumb.php?src=https://cryptoslate.com/wp-content/uploads/2024/06/blofin-logo.jpg&w=32&h=32&q=75 2x"> BloFin

Implied expected changes in interest rate levels from SOFR futures, as of Jul 16, 2024. Source: CME Group

Implied expected changes in interest rate levels from SOFR futures, as of Jul 16, 2024. Source: CME Group